Office Equipment Expense Accounting . Office equipment expense is the cost incurred to maintain and operate office equipment. This account is classified as. Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. What is office equipment expense? Office equipment is a fixed asset account in which is stored the acquisition costs of office equipment. How to classify office supplies, office expenses, and office equipment on financial statements. Office supplies are expenses that are incurred during the course of operations within the company. As a matter of fact, it can be seen.

from www.myaccountingcourse.com

Office supplies are expenses that are incurred during the course of operations within the company. Office equipment expense is the cost incurred to maintain and operate office equipment. How to classify office supplies, office expenses, and office equipment on financial statements. What is office equipment expense? Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. As a matter of fact, it can be seen. This account is classified as. Office equipment is a fixed asset account in which is stored the acquisition costs of office equipment.

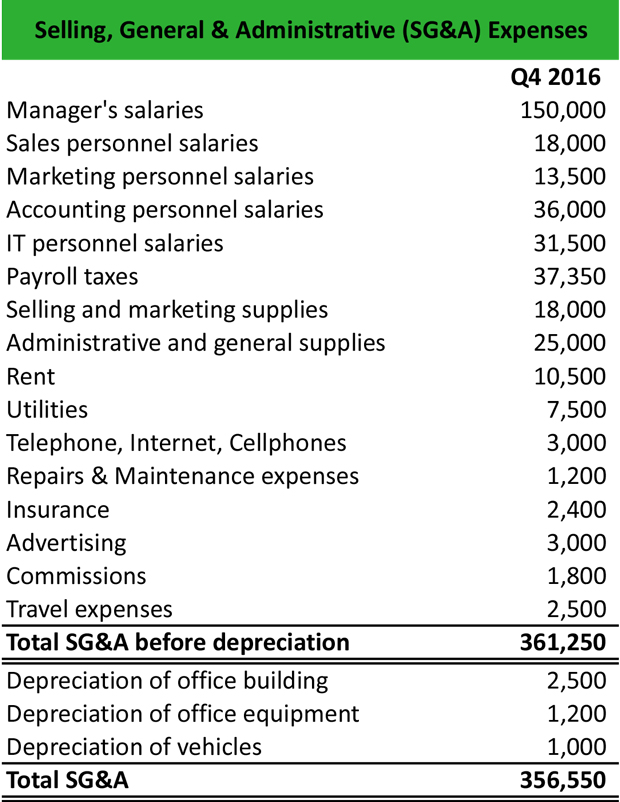

What is Selling, General & Administrative Expense (SG&A)? Definition

Office Equipment Expense Accounting Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. What is office equipment expense? How to classify office supplies, office expenses, and office equipment on financial statements. Office equipment is a fixed asset account in which is stored the acquisition costs of office equipment. Office supplies are expenses that are incurred during the course of operations within the company. Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Office equipment expense is the cost incurred to maintain and operate office equipment. As a matter of fact, it can be seen. This account is classified as.

From brainly.ph

CHART OF ACCOUNTS ASSET 101Cash 102Prepaid Rent 105Office Supplies Office Equipment Expense Accounting Office equipment expense is the cost incurred to maintain and operate office equipment. Office equipment is a fixed asset account in which is stored the acquisition costs of office equipment. This account is classified as. How to classify office supplies, office expenses, and office equipment on financial statements. As a matter of fact, it can be seen. Office supplies expense. Office Equipment Expense Accounting.

From www.superfastcpa.com

What is Office Equipment Expense? Office Equipment Expense Accounting What is office equipment expense? Office equipment expense is the cost incurred to maintain and operate office equipment. Office supplies are expenses that are incurred during the course of operations within the company. As a matter of fact, it can be seen. How to classify office supplies, office expenses, and office equipment on financial statements. Office supplies expense is the. Office Equipment Expense Accounting.

From www.pinterest.com

LetterforApprovalofOfficeEquipmentExpense2 Lettering, A formal Office Equipment Expense Accounting This account is classified as. What is office equipment expense? Office equipment expense is the cost incurred to maintain and operate office equipment. How to classify office supplies, office expenses, and office equipment on financial statements. Office supplies are expenses that are incurred during the course of operations within the company. Office supplies expense is the amount of administrative supplies. Office Equipment Expense Accounting.

From www.investopedia.com

Operating Expense (OpEx) Definition and Examples Office Equipment Expense Accounting Office supplies are expenses that are incurred during the course of operations within the company. Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. What is office equipment expense? As a matter of fact, it can be seen. This account is classified as. Office equipment expense is the cost incurred to maintain and. Office Equipment Expense Accounting.

From www.ewhsba.com

Part 1 Equipment Purchases EWH Small Business Accounting Office Equipment Expense Accounting What is office equipment expense? Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Office equipment expense is the cost incurred to maintain and operate office equipment. As a matter of fact, it can be seen. This account is classified as. Office equipment is a fixed asset account in which is stored the. Office Equipment Expense Accounting.

From swenbew.com

Office Supplies vs. Office Expense vs. Office Equipment What's the Office Equipment Expense Accounting As a matter of fact, it can be seen. Office supplies are expenses that are incurred during the course of operations within the company. What is office equipment expense? Office equipment expense is the cost incurred to maintain and operate office equipment. This account is classified as. Office equipment is a fixed asset account in which is stored the acquisition. Office Equipment Expense Accounting.

From www.chegg.com

Solved Gain on sale of equipment Office supplies expense Office Equipment Expense Accounting What is office equipment expense? Office supplies are expenses that are incurred during the course of operations within the company. This account is classified as. Office equipment expense is the cost incurred to maintain and operate office equipment. How to classify office supplies, office expenses, and office equipment on financial statements. Office equipment is a fixed asset account in which. Office Equipment Expense Accounting.

From www.coursehero.com

[Solved] I'm stuck. The homework allows me to see that my Net Office Equipment Expense Accounting Office equipment expense is the cost incurred to maintain and operate office equipment. Office equipment is a fixed asset account in which is stored the acquisition costs of office equipment. What is office equipment expense? This account is classified as. As a matter of fact, it can be seen. Office supplies are expenses that are incurred during the course of. Office Equipment Expense Accounting.

From www.youtube.com

Unit 3 VCE Accounting Prepaid expenses YouTube Office Equipment Expense Accounting How to classify office supplies, office expenses, and office equipment on financial statements. As a matter of fact, it can be seen. This account is classified as. Office equipment is a fixed asset account in which is stored the acquisition costs of office equipment. Office equipment expense is the cost incurred to maintain and operate office equipment. Office supplies are. Office Equipment Expense Accounting.

From lookoffice.wordpress.com

Office Payment Expense Accounting Look Office Office Equipment Expense Accounting As a matter of fact, it can be seen. How to classify office supplies, office expenses, and office equipment on financial statements. Office equipment expense is the cost incurred to maintain and operate office equipment. Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. This account is classified as. What is office equipment. Office Equipment Expense Accounting.

From db-excel.com

Business Expenses Spreadsheet Template Excel Expense Basic for Office Equipment Expense Accounting Office equipment is a fixed asset account in which is stored the acquisition costs of office equipment. This account is classified as. What is office equipment expense? As a matter of fact, it can be seen. Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Office supplies are expenses that are incurred during. Office Equipment Expense Accounting.

From biz.libretexts.org

3.5 Use Journal Entries to Record Transactions and Post to TAccounts Office Equipment Expense Accounting Office equipment expense is the cost incurred to maintain and operate office equipment. How to classify office supplies, office expenses, and office equipment on financial statements. Office equipment is a fixed asset account in which is stored the acquisition costs of office equipment. Office supplies are expenses that are incurred during the course of operations within the company. As a. Office Equipment Expense Accounting.

From www.homeworklib.com

FitforLife Foods reports the following statement accounts for Office Equipment Expense Accounting Office supplies are expenses that are incurred during the course of operations within the company. This account is classified as. As a matter of fact, it can be seen. Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. What is office equipment expense? Office equipment is a fixed asset account in which is. Office Equipment Expense Accounting.

From pressbooks.umn.edu

3.6 The Operating Budget An Example Producing the Urban Public Realm Office Equipment Expense Accounting What is office equipment expense? Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Office equipment is a fixed asset account in which is stored the acquisition costs of office equipment. As a matter of fact, it can be seen. Office supplies are expenses that are incurred during the course of operations within. Office Equipment Expense Accounting.

From accountingqanda.blogspot.com

Accounting Questions and Answers PR 31A Adjusting entries Office Equipment Expense Accounting How to classify office supplies, office expenses, and office equipment on financial statements. As a matter of fact, it can be seen. Office supplies are expenses that are incurred during the course of operations within the company. Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. What is office equipment expense? Office equipment. Office Equipment Expense Accounting.

From www.thecopierguy.my

Understanding Office Equipment In Accounting & Tax The Copier Guy Office Equipment Expense Accounting This account is classified as. How to classify office supplies, office expenses, and office equipment on financial statements. Office equipment expense is the cost incurred to maintain and operate office equipment. Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. As a matter of fact, it can be seen. Office supplies are expenses. Office Equipment Expense Accounting.

From www.excelwordtemplate.com

Expense Report Template Excel Word Template Office Equipment Expense Accounting Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. How to classify office supplies, office expenses, and office equipment on financial statements. Office supplies are expenses that are incurred during the course of operations within the company. Office equipment is a fixed asset account in which is stored the acquisition costs of office. Office Equipment Expense Accounting.

From www.pinterest.com.au

Expense Trackers The Top Six Tools For Small Businesses Bench Office Equipment Expense Accounting Office equipment expense is the cost incurred to maintain and operate office equipment. What is office equipment expense? Office supplies expense is the amount of administrative supplies charged to expense in a reporting period. Office supplies are expenses that are incurred during the course of operations within the company. Office equipment is a fixed asset account in which is stored. Office Equipment Expense Accounting.